The Dopamine Elasticity Theory

Understanding how this neuron drives price elasticity and inelasticity

Disclaimer: If you are new to the blog, then you may want to revisit my blog on the basics of dopamine, which is explained in a simple manner.

If you've been following my blog for a while, or if you're generally familiar with the concept, then you probably know what dopamine is by now and can continue reading the blog.

Warren Buffett and Charlie Munger invested in a company called See’s Candies, which is considered one of their best investments of all time. They are often seen with a box of See’s Candies at their press conferences.

Here are See’s Candy's historical financials for your reference:

Over the years, See’s Candy’s revenue kept consistently increasing, including the price per pound of candy, while the quantity available remained the same.

Buffett and Munger paid $20 million for See’s Candies at three times book value, which was far beyond their typical valuation parameters when buying a company to invest in.

They bought See’s Candies and gave the company full freedom to run it how they liked, with one condition: that they test raising the prices of their candies by 10-15% at the end of the year to see if people would still buy, despite inflation being 3-5%.

People still continued to come back for more.

The price increase was largely immune to the corresponding rise in inflation. They continued this strategy for many years, and it kept working.

Today, they make billions of dollars in dividends from See’s Candy.

The See’s Candy investment also indirectly led to their investment in Coca-Cola.

With the dividends they made from See’s, they were able to purchase a significant amount of Coca-Cola shares.

So, what made See’s Candy, a simple sweet manufacturer, such an outstanding business?

Yes, the quality of the sweets makes people return, but what other key factor ensures that a consumer doesn’t get bored with the same treat?

Branding, distribution, cost control, pricing, and all the traditional business metrics certainly play a role, but there is one often overlooked aspect—a scientific factor.

A MOAT in a business is a rare quality that allows a company to raise prices and maintain margins due to the superior nature of its product and its resistance to replication.

Despite recessions or poor economic conditions, See’s Candies continued to thrive.

However, See’s Candy probably has a Scientific MOAT that made life easier for the investing legends—it's called dopamine.

This neurotransmitter dictates our level of addiction to products or activities in our lives.

The dopamine-inducing properties of the sugar-filled candy played a significant role, beyond just the quality of the business in my sense.

The more dopamine a drug releases and the faster it releases it, the more addictive the drug becomes!

Some items on the high cheap dopamine list”

Chocolate- 55%

Nicotine- 150%

Cocaine- 225%

Amphetamine- 1000%

This is the rate of dopamine released per addictive substance. As you can see, these are some of the items that can get your brain really hooked on the substance.

In the same way, alcohol works in any recession. Its dopamine-inducing effect ensures the consumer comes back wanting more.

The same is true with nicotine. Folks invest in tobacco companies due to their relative price inelasticity and immunity to change.

What is price elasticity and how is it connected to this concept of dopamine?

The price elasticity of the food index measures how the consumption of items is impacted by a change in the price of the item.

This index covers how much of it a consumer would buy based on the rate of changes in the price (i.e., how much the consumer is addicted to the dopamine hits from the product).

I would argue that price is a derivative of the dopamine-inducing properties of an item. Let’s dig into why this is so.

A high index means that people will continue to buy the product even if the price increases, which means the food is “price inelastic.”

Conversely, a low index means that people will not buy the product if the price increases, indicating that the food is “price elastic.”

A wide-scale experiment in 2010 reviewed 160 studies on the price elasticity of demand for major food categories to assess mean elasticities by food category and variations in estimates by study design.

For example, the most price-elastic food item is eggs, with an elasticity of 0.32. This means that if the price of eggs goes up by 1%, consumption will decrease by 0.68%.

Even though eggs have multiple benefits, they fail to drive a strong dopamine response in individuals.

However, foods high on the index, like fast food and soft drinks, have a price elasticity of 0.80 and 0.79, meaning a 1% rise in cost will only cause a small 0.20% and 0.21% decrease in sales per unit.

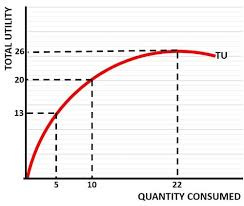

Marginal Utility of Economics that I learned in college taught me that the consumer starts to consume less of the product with every passing unit and after a certain point the utility from that product consumed keeps coming down.

Chart Source: Dying Economy

Dopamine ensures that the theory I learned in college remains only a textbook concept for addictive items.

Conclusion

Money is just a part of the dopamine game.

Once you understand, you will know that it’s dopamine that drives the world crazy.

The actual reward is not measured in dollars, yen, rupees, or pounds.

It's measured in dopamine.

It's dopamine that makes the world go round :)

Relevant sources from my blog and socials to understand dopamine better:

Superb article 👏👏👏👏👏 How beautifully you have covered two different aspects in the single article. From the business point of a view and as well from health perspective. It is really great.