Quitters Are Winners

Why we often fail to let go of investments, relationships, projects that we have spent our valuable time and money on. We should learn to quit more.

Sunk Cost- A cost that is incurred and one that cannot be recovered.

Our textbooks teach us about this cost in an economic sense but this cost presents itself in real life also in the form of:

spending too much time on activities we may not particularly enjoy

spending too much time on a relationship we are scared of losing

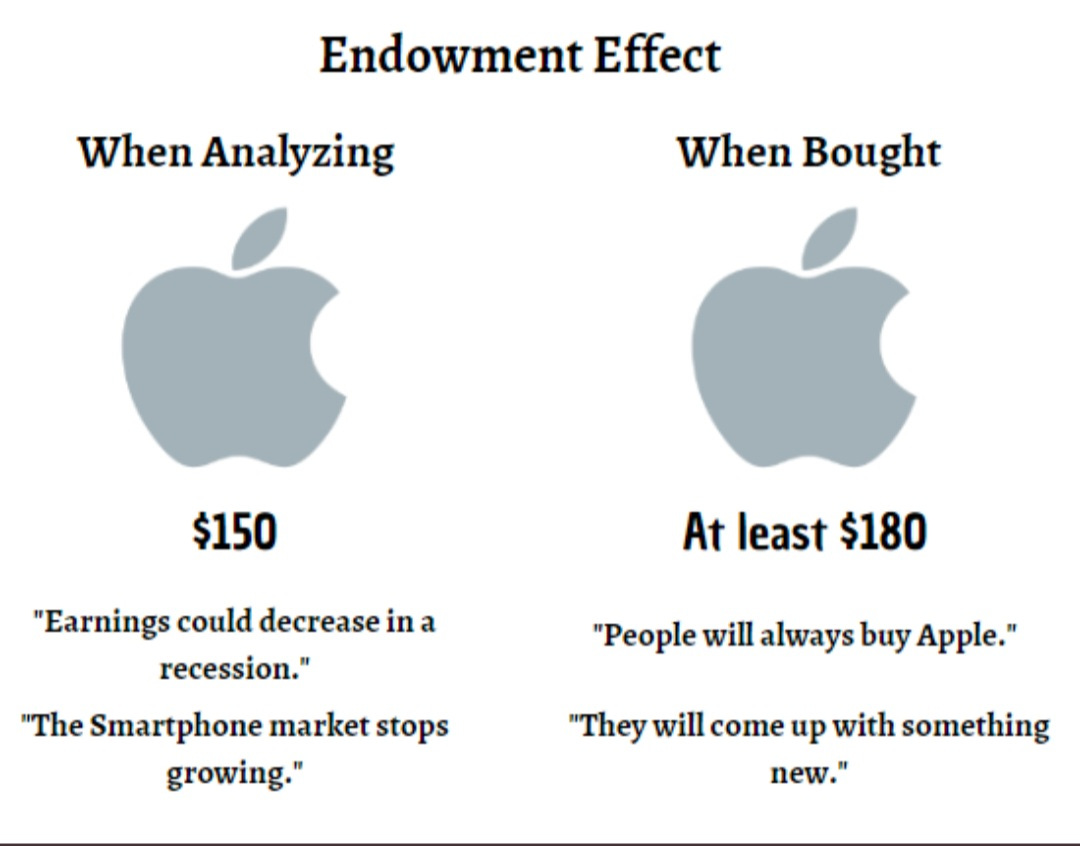

investment in a stock we become too emotionally attached to and hence hold on to

There is a human tendency to hold on to things in which we have invested too much time or money, and we are scared of what may happen if we are faced with uncertainty over letting go.

A sunk cost can also be in the form of an opportunity cost, that is, the benefit that has been forgone as a result of not pursing an alternative use of one’s resources.

Readers of my previous blog posts know that I use my experiences and readings to help explain concepts.

In his bestselling book The Dip, Seth Godin persuasively argues that “Winners quit all the time. They just quit the right stuff at the right time.”

While dismissing the famous Vince Lombardi line that "Quitters never win and winners never quit," Godin explains three curves in an individual’s road to mastery in any field of activity: the dip, the cul-de-sac, and the cliff. “The Dip” is the difficult phase one inevitably encounters after the initial enthusiastic spurt, as one struggles to surge to higher levels. Godin strongly advocates against quitting during the “Dip” as this is a necessary obstacle to overcome on one’s road to mastery. On the other hand, a cul-de-sac is a dead-end, while a cliff (like falling off a cliff) is a complete end-point. Godin sensibly argues that the cul-de-sac and the cliff should be recognized for what they are and one must quit promptly and without hesitation when one finds oneself in these situations.

According to Seth, the important thing to understand whether switching is simply a failure of perseverance, or an astute recognition that a better match is available.

He says “We fail” when we stick with “tasks we don’t have the guts to quit”

This is the theme of today’s blog.

Investors in the market and students of Finance know of Type 1 and Type 2 Errors in investing. These errors have real life applications beyond investing too;

In a Type 1 Error –often referred to as False Positive – the null hypothesis* is rejected when it is actually true.

*(In statistics, the “null hypothesis” avers that given observations do not have sufficient statistical significance to assert or negate a hypothesis)

For example: Incorrectly construing the rustling of the wind afar as the sound of a lion and running away

In stock market terms, this would be an incorrect assessment of a quality company as one with poor corporate governance, resulting in not buying what should have been bought or in selling what should not have been sold

In the above examples, man’s conservative actions would not cause substantial harm or loss.

A Type 2 Error could have much more dire consequences.

A Type 2 Error – often referred to as False Negative – results in failing to reject the null hypothesis when it is actually false.

For example: Incorrectly construing the sound of a lion as the rustling of the wind afar and staying put.

In stock market terms, incorrectly construing a company with poor corporate governance as a quality company, resulting in buying what should not have been bought or not selling what should have been sold.

In both these examples, there could be a considerable loss of financial capital.

These are two thinking errors commonly described in textbooks on Finance.

There is also a third type of error that lies between these two that is not mentioned in textbooks. It is, in a manner of speaking, a type 1.5 error. I learnt this concept from an outstanding lecture by Utpal Seth on common errors made in investing decisions, for the CFA Society.

As Utpal Seth explained it, the type 1.5 error refers to not buying enough quantum of what should have been bought or not selling enough quantum of what should have been sold. The sunk cost fallacy plays a role in this type of error, too.

The stock market is where I professionally work a Type 1.5 Error could be applied by analogy to other walks of life.

At PhillipCapital, the investment firm where I work, my fund manager emphasizes a key guiding principle for our fund, which is, to hold on to our winners as long as possible and sell off the losers as soon as possible rather than waiting for the stock prices to recover. This principle is based on the wisdom that has accrued from many years of investing experience in the stock markets.

2 examples of stocks that we illustrate in the PhillipCapital fund presentation, showcasing how persevering with losers in the portfolio can be a bad move:

In her book, The Confidence Game, professional poker player Maria Konnikova states that the tendency to recover sunk costs is so deeply entrenched in our minds that in poker it is hard to walk away when we are losing and we keep buying in more.

I have been a victim of this fallacy multiple times over during my college poker-playing days with friends. If any of my friends who I played poker with are reading this, you know how often we have fallen prey to this fallacy.

This fallacy can be seen at play often in the stock markets. Investors keep averaging down on poor quality companies in the hope of recovering their capital and making a gain on their average buying price.

American Apparel founder Don Charney is a classic illustration of this fallacy in the field of business. After building the popular brand “American Apparel,” he did not know when to sell out and quit the business. Being the founder, he was too emotionally attached to the business and faced with intense competition and declining profits, he kept doing leveraged buyouts to keep the company afloat. As is well known, the story didn’t end well for him.

Businesses that continue to cling on to loss-making segments in the hope that they turn around could be causing destruction of capital for investors. Consequently, such businesses often receive a lower valuation multiple from the markets. Businesses that are able to turn around or hive off loss-making segments often get improved multiples and tend to see their stock prices gain in response.

Even a doctor has to call death at some point.

Most people I know who have invested in Bitcoin, Ethereum, and other cryptocurrencies are holding on to these asset classes as they feel they have invested too much time and money in them and find it emotionally difficult to let go in favor of other opportune investments. Holding to the asset in a distressed time tests one’s ability to analyze opportunity costs.

If you have analyzed the future prospects of crypto and are convinced about its value, that could be a valid reason to hold on to the investment. If, however, you have merely punted with a hazy understanding of what you are doing, it is better to let go and invest in something in which you have a firmer footing. You will thereby avert the opportunity cost of losing out on a better, more gainful investment.

I recently finished reading Thinking in Bets by Annie Duke. The author persuasively emphasizes the importance of quitting.

" Anytime you stick to something when there are better opportunities out there, that is when you are slowing your progress. Contrary to popular belief, quitting will get you to where you want to go faster."

— Source Quitting Annie Duke

Annie Duke has further emphasized this point in her work in her most recent book Quit: The Power of Knowing When to Walk Away. In Annie Duke’s view, mastering the art of quitting is essential to making good decisions.

If one has to persevere he has to quit, be willing to quit other things.

In the startup world- the word ‘pivot’ has been conveniently used to replace the word ‘quitting’. Pivot is just a sexier word for quitting 🙂

Quitting often gets the Voldermort treatment in society.

The problem is that goals are fixed objects in a changing world and hence we find it difficult to quit and start over.

Renowned psychologist Daniel Kahneman even has a quitting coach in Richard Thaler, dubbed “The Father of Behavioral Economics.” In this brilliant piece attached below, he emphasizes the importance to all of us using a quitting coach. Thaler states that we as humans, don't like closing mental accounts of losses. We are usually unwilling to quit until it's no longer a choice.

https://thedecisionlab.com/biases/mental-accounting

Take the example of long-distance running. When you run a marathon, if you complete 35 kms, you have gained that much distance. However, the cognitive mind says we failed and didn't finish 42 kms. If your body is physically not able to complete the remaining 7 kms, it is okay to quit rather than break your body to finish those remaining 7 kms.

"Dropping one's tools is a proxy for unlearning, for adaptation, for flexibility. It is the very unwillingness of people to drop their tools that turns some of these dramas into tragedies."

Kodak and Nokia are examples of great global corporations that didn’t know when to call an end to things and simply went on and on. They didn’t know when to quit and drop their tools. Innovate and survive sounds sexier than Quit and Survive.

Consider the case of Lego, the company whose products have captivated children and adults across generations. In the 1990s, due to the company’s great success, it decided to venture into multiple territories such as clothing, jewelry, and watches and also started its own video game and theme parks division.

In 2001, their new CEO decided to take Lego “back to the brick” and jettison the process of diversification. Sales soared and it became the number 1 toy company in the world, surpassing Hasbro and Mattel, its two largest competitors.

Diversification fails if you lose sight of what you first set out to achieve. Lego went back to its roots and focused on innovating in a category they excelled at in tune with the changing times rather than changing its ethos to fit in with the changing times.

Lego realized that it needed to drop its tools and focus on its core strength by accepting the sunk costs of the time and money expended on the wasteful attempt at diversification.

Stewart Butterfield founded Flickr, one of the most successful photo―sharing companies of the 2000s. However Flickr was the byproduct of a failed venture of a game he developed called Never Ending, an open world multiplayer game. He used one of the concepts of photo sharing in that game to build a different business called Flickr. He successfully sold Flickr to Yahoo for 17 Mn USD in 2008. Determined to start another venture, he started a company in 2011 called Glitch, which is an open-world cooperative game on lines similar to Never Ending, The game turned out to work fine but the hypergrowth was coming in service of only 5% of paid users, getting the remaining 95% of users to pay for the game would be a mammoth task, especially in the wake of intense competition in the gaming industry. Therefore, despite having 6 Mn USD in the bank, Butterfield decided in 2013 to fold up the business and return the money to his investors. He was hitting a dead end for that business.

When Butterfield freed himself up in 2013, he went on to develop another product- an idea he developed while working on Glitch. It was an internal communications tool which combined the best of text messaging, emails, and social communications. The full form of the app is “Searchable Log of all Conversation and Knowledge.”

This app is better known by its short form, “Slack.” Slack became a publicly listed company in 2019 and was acquired in 2020 by Salesforce for 27 Bn USD. Quitting on time helped Butterfield move on to a phenomenally more productive venture.

In his book Range, David Epstein illustrates the problem with too much “Grit” by citing the example of Vincent Van Gogh. Vincent Van Gogh, one of the most famous painters of all time, exemplified the art of dropping one’s tools to excel in life.

Although Van Gogh’s mother was deeply interested in art and music, Van Gogh himself had shown no inclination towards art or music in his childhood. His first boarding school placed an emphasis on the principles of art education, but he left the school at age 15. He moved to his uncle’s art dealership in London, where he showed no interest in the work, and instead, grew to be engrossed in religion. He left that pursuit too. He then moved from failing as a teacher of the French language to failing as a book clerk at a bookstore. He then tried his hand at becoming a broker in the financial services industry, seeking to replicate the success that his art dealer uncle had had in making money in the midst of the economic revolution. That move failed miserably, too. He then moved on to carpentry.

After all these wanderings, he entered art school at age 33, in the hopes of finding his calling, but did not enjoy the way the art was being taught. His art dealer uncle even told him that it was too late for him to start over.

In a fit of rage, he went one day to a nearby sand dune in and started splattering oil paints onto a canvas with amidst swirling winds. He found that the vicious speed of the sand caused his hands to shake and forced him to perfect his strokes. During this process he got the epiphany that the work of art he enjoys indicated that trying to be perfect was not his kind of art. He found his calling though these vivid moments and started delving deeper into the arts.

His paintings delineate his interpretations of his life experiences with failures.

In Hindu mythology, Shiva is the Destroyer and Vishnu is the Creator. We need to channel our inner Shiva and Vishnu at times to get to where we want to be.

There is no denying that this is more easily said than done. Amidst the cult of success that is the hallmark of the zeitgeist, we need to laud the act of starting over as it could be a key move in the achievement of the success that society glorifies.

Good examples in industry, marathon, poker and art. You might want to expand on “even a doctor has to call death at some point “! The patient quit and the doctor pivot!

Superb articulation. Wonderful diverse examples. Did not know all the pursuits of vg before taking on art.