Data vs Emotion

Becoming emotionless to the data takes conditioning, but that doesn't mean we ignore our emotions

I recently completed reading this outstanding book by David Brooks called How to Know a Person, and a definition of two types of certain people that Brooks quotes in his book has stuck with me ever since.

In his book, David Brooks quotes the work of psychologist Jerome Bruner who distinguishes between two different modes of thinking: the paradigmatic mode and the narrative mode.

The paradigmatic mode is analytical. It’s about making an argument. It’s a mental state that involves amassing data, collecting evidence, and offering a hypothesis.

A lot of us live our lives in paradigmatic mode which involves making PPTs, legal briefs, issuing orders, or any other linear work.

Paradigmatic thinking is a powerful tool for understanding data, making a case for a proposition, and analyzing trends across populations. But it’s not neccesarily great for seeing and understanding an individual person.

The narrative mode, on the other hand, is essential for understanding the unique individual in front of you and their story.

Stories capture the essence of a person’s character how they change over time, how a thousand little influences shape a life. They show how people struggle, strive, and are knocked about by lucky and unlucky breaks.

When someone tells you their story, you access a different kind of truth.

The book also goes on to suggest that what you do for a living shapes who you become.

If you spend most of your day in paradigmatic mode, you're likely to slip into certain mental habits you may start to see storytelling as non-rigorous or even childish. And if you do that, you’ll often misunderstand people.

The field of investing requires a careful balance between these two modes of thinking, whether we are investing or managing a client’s expectation when they are investing.

Data doesn’t lie and it does dictate long-term performance, but even unique life circumstances and stories of people don’t lie, and it is very important to combine data with a person’s unique life experience, expectation, and temperament.

Medicine is a science, yes. But the bedside manner and empathy of a doctor are just as important. Even when a patient understands the data, they find comfort in a doctor who balances both information and emotion.

A nutritionist who relies on data-driven studies is incredibly valuable. But so is the one who understands a client’s emotional, personal, and cultural context. The coach who grasps this nuance will always manage the client better.

The world functions on numbers. But it can’t function on numbers alone :)

My profession of investment management thrives on data and hard numbers because, over the long term, markets more or less obey data; however, over the short term, the data can get fuzzy and distorted, which can lead clients and even portfolio managers to weight emotion over data.

Currently in India, war with our neighbour is topic in focus and the word ‘war’ affects the cool composure of even long term investors due to the jitteriness of the situation.

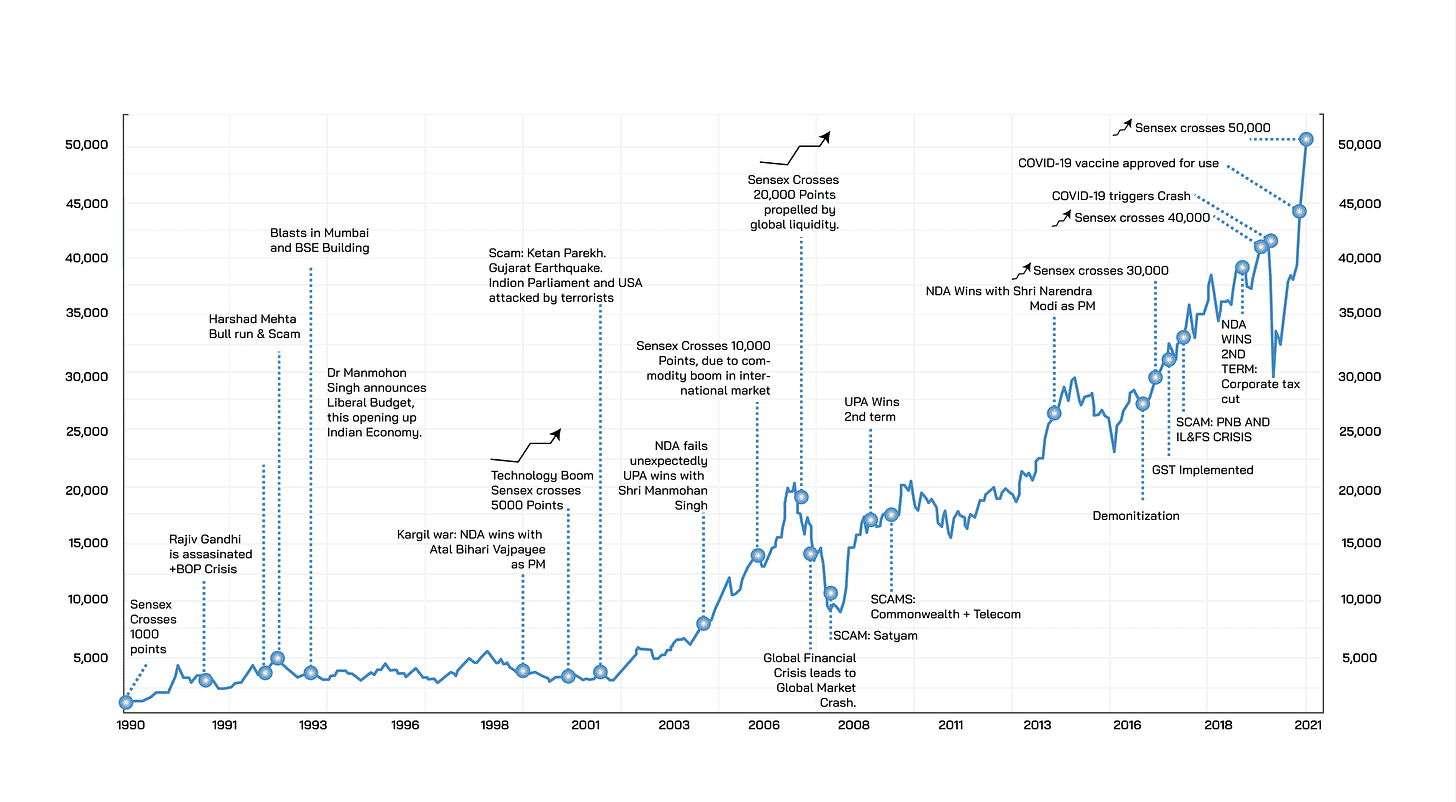

For example- let me give you some data (Source: SOIC Daily Investor Edge)

Historical Resilience: In four major India–Pakistan standoffs since 1999 (Kargil, Parliament attack, Uri strikes, Pulwama/Balakot), the Nifty 50 never dropped more than 2%, except during the 2001 Parliament attack (‑13.9%). 2001 drop was also coincided with global turmoil as at that point S&P 500 was also down close to 30%

Global Conflict Norms: Across 25 major conflicts worldwide, equities average a 7% correction (median 3.2%).

Current Tensions: Renewed India–Pakistan friction may spark short‑term volatility, but a steep market crash seems unlikely seeing the historical trends

It’s impossible to predict what impact these conflicts will even have on the markets in the short term but history has shown in the journey of a long term investor that these conflicts have always taken place.

‘The Sensex has gone up 670x from 1979 to 2024, and there were 10,500 trading days during this period. If you rank the days from best to worst, the top 112 days have contributed to the entire 670x returns that the Sensex has delivered over this period.

These 112 days account for around 1% of the total number of trading days!’

Emotions would have caused you to miss those days.

Research done by Zerodha Varsity highlights a similar theory that missing just 10 days of being invested in the market from October 2003 to October 2023, which is a fairly long sample size, would cause your returns to differ from 15.7% CAGR to 11.6% CAGR a 4.1% CAGR difference over 20 years. This means that the 1 lakh you invested in 2003 would be only Rs 9 lakhs if you had missed the top 10 trading days, as opposed to Rs 18.6 lakhs as your final amount if you had stayed invested through the ups and downs.

Of course, it gets worse as you miss more days, which the chart clearly highlights.

This phenomenon played out in the last few months as well, as Nifty proceeded from the lows of about 22,000 to 24,500 today despite all the madness happening around in the world.

Now some people will debate with me that a war or conflict like this hasn’t ever happened in the past or that geopolitics has never been where it is today or that this is just a relief rally.

But what do we get by debating about this?

These same questions would have been asked by investors during all the previous conflicts. But the world still moved on.

Investing is an extremely emotionless profession when it comes to pulling the trigger. (as it is for a soldier, I’m assuming).

This is ironic because during these conflicting times, we become extremely emotional.

As a matter of fact, so was I over the last few weeks.

But the fact of the matter is that the stock market does not care about how I feel, it moves on faster than my emotions.

I saw some posts and even reputed voices saying things like:

“You cannot buy the dip during a correction due to war” OR

“You cannot short the markets during a war as it would be an act of treason.”

I understand these emotions. I felt them myself, in my own ways. And I understand that people may continue to feel this way for a long time. That’s just natural love for the country and nothing to be ashamed of.

But is a clear example that even the most seasonsed professionals tend to discard hard data and allow their emotions to overpower them.

So how can we blame an investor who does not have professional experience to navigate such situations?

Over time and experience, I’ve learned and toughened my mind to separate data from my feelings. And because of this mental toughness, I’m better equipped to help investors navigate these emotions, especially those going through this kind of experience for the first time.

When communicating with clients, friends, or anyone who needs assistance,

Empathy + Data is what comforts the person who has put their hard-earned money to work.

It’s all the more reason why profiling a client is such a key parameter. It helps in creating an asset allocation plan that allows them to stomach these kinds of situations on an emotional level because investing over the long term boils down to the power of our stomach more than the power of our brain.

It’s the reason why in our profession we have to balance the paradigmatic and narrative mode of thinking when speaking to a client.

The brain isn’t wired for delayed gratification or compounding.

It craves quick rewards. It thinks in straight lines not exponential curves.

That’s why saving, investing, or building habits feels hard in times of turmoil even after we’ve lived through various turmoils before.

Long-term thinking is a skill that’s developed not a default setting. Taking control of your emotions is also a skill that is built not something you can summon on demand.

Conclusion

Yes, data does not lie. Data is unbiased. Data does not care about our feelings.

All of these statements are true.

But human beings are emotional creatures regardless of the data. And understanding our own temperament is the key to lasting success in this profession.

An investing plan should be tailored over the long term for the investor to be able to stomach crises such as this based on their temparament, while also leaving room in their mind to focus on the long-term data.

Order my book- The Health and Wealth Paradox

Well written. Its hard to do as our perception is short term. But a long term perspective keeps things in check with our emotions.